How Africa Became Airtel's Most Profitable Market

- Rohan Nidmarti

- Nov 13, 2021

- 4 min read

Yes, you read that right. On most relevant parameters, Africa, and not India, is Airtel's most profitable market. Africa accounts for 27% of Airtel's 400 million subscribers, however, Airtel Africa's average-revenue-per-user (ARPU), at Rs 210, is 40% more than Airtel India's. To understand how an Indian company penetrated Africa's crowded telecom market, we need to travel back to 2008.

MTN Merger:

The telecom industry in India was displaying the typical characteristics of reaching maturity by 2008. This was followed by price wars in the telecom sector with the entry of many private players such like Idea, BPL Mobile, Spice, Aircel. The impact was clearly reflected on Airtel's ARPU which registered a decline from Rs 505 in 2005 to Rs 271 in 2010. Sensing the changing dynamics in the domestic market, Airtel's management decided to establish operations abroad.

In January 2009, Airtel launched Airtel Sri Lanka and followed it up by acquiring 70% in Warid Telecom, Bangladesh. It was during this expansion mode that Airtel decided to take their bet in the African telecom market. In May 2008, Airtel began exploring the possibility of acquiring the MTN Group, a South-African telecom operating in 21 countries in Africa and the Middle-East. After eight months of discussion, both firms reached an agreement for a $23 billion alliance to create the world's fourth largest telecom company spanning 24 countries and 200 million subscribers. As per the deal structure, Airtel would pay $23 billion in exchange for a 49% stake in MTN Group.

However, the problem started when the South African government demanded for dual listing of shares. They refused to budge from this demand. As the Indian rupee was not fully convertible, it was not possible to go in for dual listing. The deal fell through after two crucial meetings in South Africa.

New Beginnings:

Airtel was determined to get into the high-potential African market. The next best choice was Kuwaiti firm, Zain. The negotiations were set in place through 2009 and the deal was finalised in May 2010 with Airtel paying $10.7 billion for Zain's African assets. Zain's crown jewel was its Nigerian operations - which it acquired from Celtel in 2008.

In August 2010, Airtel acquired Telecom Seychelles, for $62 million, taking its global presence to 19 countries. The company has over 57% market share of the mobile market in Seychelles. Airtel was awarded a license to operate mobile services in Rwanda in 2011. In December 2017, Airtel reached an agreement with competitor Millicom to acquire control of Tigo Rwanda at a cost of $65 million, which made Airtel the largest mobile operator in Rwanda with a 59% market share.

Airtel's Africa Vision:

Airtel was well aware that they could not treat all 16 countries as a homogenous Africa. Every country was different in terms of market dynamics, consumer behaviour, consumer expectations, government rules, and tax structures. Airtel had to formulate different strategies for different countries since customers were different.

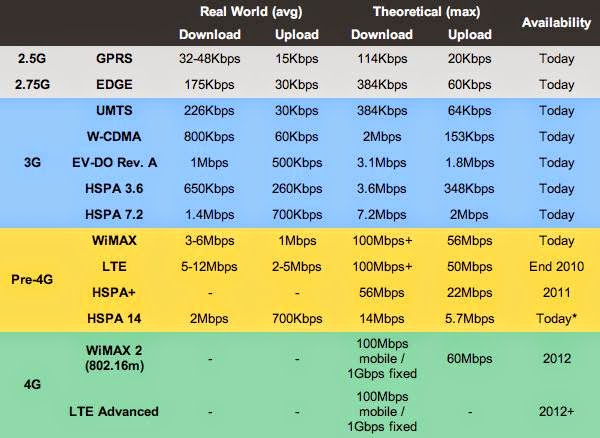

In 2013, Airtel fully acquired Warid Telecom Uganda. With this, Airtel further consolidated its position in Uganda with 7.4 million customers, In 2018, Airtel Uganda reached the 10 million customer mark, and achieved 100% 4G LTE in Uganda. Airtel now has a 38% market share in Uganda, behind MTN Group. Airtel also has a 30% market share in Tanzania with 11 million customers, and was the first telecom company to launch GPRS/EDGE in the country.

Airtel is the market leader in Chad, Gabon, Malawi, Niger, Congo, Seychelles, Zambia.

Airtel is the 2nd largest operator in DRC, Kenya, Madagascar, and Uganda.

Airtel is the 3rd largest operator in Nigeria and Tanzania.

In 2015, Airtel decided to divest its non-core assets in Burkina Faso and Sierra Leone, and entered an agreement to sell the operations to Orange S.A for $850 million. Airtel sold its Ghana operations to the Ghanaian government in 2020 for $25 million.

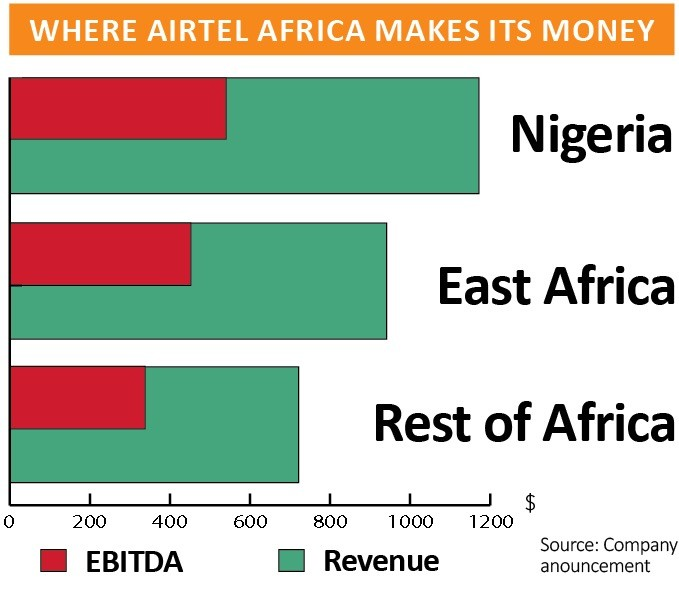

Performance:

Airtel Africa reported a record EBITDA margin of 32.1% in 2020. It sold 10,540 cell towers in 10 countries, and has now decided on being one of the top two players in all African countries it operates in. 3G has been rolled out in 15 countries and 4G across 3 countries.

While data growth and adoption of mobile money are central to the growth of Airtel's operations in Africa, its strategy in the continent of strengthening distribution, modernising networks, and bundling products is beginning to pay off. Airtel Money has grown at the rate of 30% year-on-year with annual transactions reaching almost $20 billion. This year, Airtel Africa sold 18.75% of its mobile money business to MasterCard, TPG Capital, and Qatar Investment Authority for $500 million.

Out of the 110 million subscribers of Airtel Africa, only 35 million used data services. Thus, Airtel Africa has a 45-40% smartphone penetration, which means there is potential to grow voice, data, and because of lower banking penetration, there is enough potential to grow mobile money. In late-2018, marquee global investors like Warburg Pincus, Temasek, & SoftBank invested $1.25 billion in Airtel Africa, and helped the company significantly reduce debt. In 2019, Airtel Africa got listed in the London Stock Exchange, and the stock is up 98% since then, and almost 70% in the last 10 months. Today, Airtel Africa is valued at $6.8 billion and Airtel is valued at $58 billion.

If Airtel has to survive in the cut-throat Indian market, it will continue to have large dependence on Africa. As for Airtel Founder Sunil Mittal, he can take pride in the fact that his ambitious bet to diversify in other geographies and reduce the dependence on India has paid off, and has silenced those investors who once questioned his decision.

Thankyou so much for reading! Please do subscribe

Comments