Shein: China's Mysterious $47 Billion Retailer

- Rohan Nidmarti

- Sep 11, 2021

- 4 min read

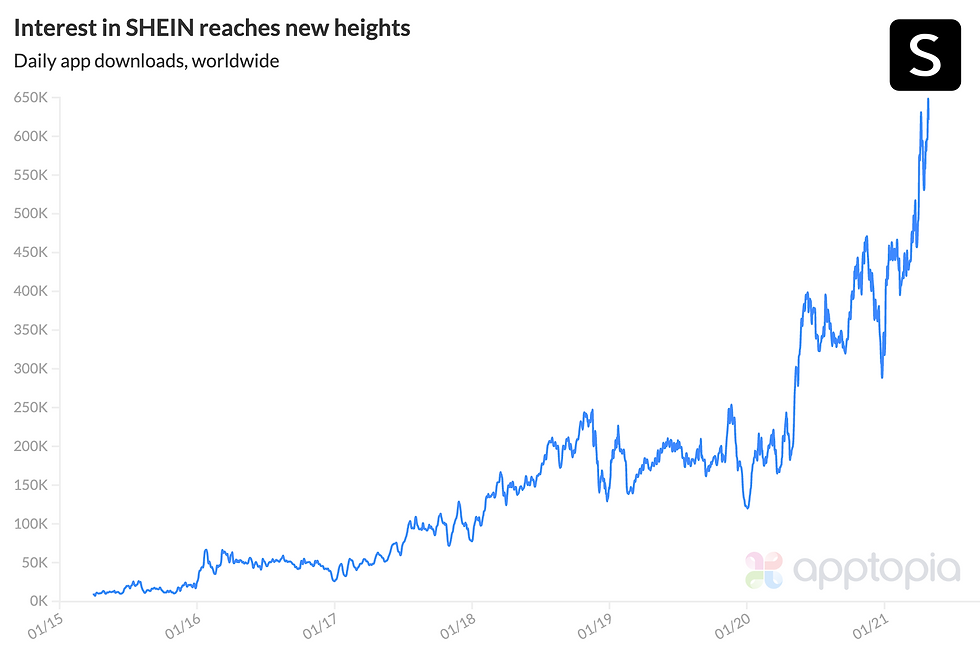

Shein may may not be a household name like e-commerce giants, Alibaba, Taobao, JD.com, but China's newest decacorn has only one ambition: Becoming a global fast-fashion retailer and taking on the heavyweights, such as Zara, H&M, & Uniqlo.

Founded in 2008, Nanjing-based Shein is aimed squarely at Gen-Z, luring young shoppers via Instagram & TikTok and a barrage of discount codes for low-cost styles - with a dress costing half that of a Zara equivalent - uploading new products online every day. Yet, beyond its teen audience, ultra-publicity shy Shein remains largely unknown, however, with an IPO coming soon (at a $47 billion valuation), Shein is ready to take on Main Street.

Beginning:

The story starts at the beginning of 2012, when founder and CEO Chris Xu, an American-born graduate of Washington University, acquired the domain Sheinside. Initially selling women's clothing, in 2013 he renamed the company Shein, focused on overseas markets and began snapping up fashion rivals. He realised the commercial value of selling Chinese goods to international markets via the internet.

Xu would scour the Chinese wholesale clothes market for items he thought had the potential to be popular in Western markets. Products were advertised on the website and purchased from the wholesaler once demand was sufficient. By 2015, Shein had 100 full-time employees, and had established their headquarters in Guangzhou, China from which Shein uses an agile supply chain system known as 'real-time retail'.

In recent years, Shein has acquired multiple fashion rivals to become a truly global presence. The company claims to ship to 220 countries and territories with annual revenue estimated to be $10 billion.

The Industry:

To understand how we got to the Shein business model, it's worth highlighting the evolution of the fashion industry, from a business standpoint, of the last decades. By the late 1990s, early 2000s, a phenomenon driven by companies such as Zara and H&M took over: fast fashion

Fast fashion was based on a few key premises. If we take Zara, who most represented this phenomenon, the company leveraged fast following trends developed by high-fashion brands. It built it strengths on shorter manufacturing cycles, just-in-time logistics, and massive investments in flagship stores located most city centres across the globe. This model enabled the stores to operate at a fast turnover by offering a wide variety of inexpensive clothes that changed every week.

This business model worked pretty well till the 2010s. Since then, e-commerce penetration has dramatically increased in most European countries, also favoured by the birth of mobile commerce. Hundreds of millions of Chinese consumers got online natively with their smartphones. This played a key role in developing ultra-fast fashion.

Ultra-fast fashion worked as an evolution from fast-fashion. Its key strengths relied on a strong online presence, primarily driven by mobile e-commerce. That managed to create a feedback loop between users' feedback about fashion trends, manufacturing, and the quick availability of these items on the digital properties of the ultra-fast fashion retailer.

In short, ultra-fast fashion retailers invest most of their resources in in capturing fashion trends even faster by further shortening manufacturing cycles and making its items readily available on its online properties, and therefore investing massively in logistics to easily distribute these clothes to million of customers across the world, without the burden of physical stores.

At the core of Shein is real-time retail. The cycle from picking up fashion trends to clothes collections shortens to just a few days. Shein mastered the digital distribution channels into its business model.

Revenue Generation:

Shein makes money by purchasing clothes from wholesalers and then selling items for a profit. However, the company has several unique ways of maximising its profits.

1) Ghost Factories: Food-delivery apps that run ghost-kitchens appeal to consumers who prioritise price and convenience over the brand or name of the restaurant. These apps control the order management system of the restaurant and provide real-time inventory data.

Instead of ghost kitchens, Shein runs ghost factories. The company approaches factories with archaic inventory management practices and offers to install its own order system in exchange for guaranteed consumer demand. Shein teaches factories how to respond to real-time consumer preferences, and in the process, make the fashion retailer more money.

2) Targeted Marketing: The fast-fashion model is mainly targeted at young shoppers between ages 15-25. Shein targets this demographic by offering on-trend clothing at competitive prices.

Shein is vertically integrated. Through high-volume manufacturing, it also benefits from economies of scale. Both these factors allow Shein to undercut competitors such as H&M, Zara, & ASOS.

Brand awareness is focused on social media platforms such as Instagram, YouTube, & TikTok. This targets the younger generation who tend to discover new fashion brands through real-life friendships & recommendations.

3) Gamification: Shein drives more revenues by gamifying the consumer purchasing experience. For one, there are so many different products for sale that finding a clothing item that replicates a high-end look is like finding a needle in a haystack. This is made all the more difficult when one considers that many popular clothing items become sold out very quickly.

These factors have resulted in so-called 'Shein haul' vlogs where satisfied customers proudly share clothing finds with others. This drives brand loyalty and increases word-of-mouth advertising.

Conclusion:

Shein and hundreds of factories that work with the company have coalesced in a production cluster bearing close similarities to A Coruna in north-east Spain, where Zara's headquarters are surrounded by its upstream and downstream suppliers. Shein has four R&D facilities in Nanjing, Shenzhen, Guangzhou, & Hangzhou, plus six logistics centres in Foshan, Nansha, Belgium, India, and on the East & West Coasts of the US. It has seven customer service centres, based out of Los Angeles, Liege, Manila, Yiwu, & Nanjing, and employees more than 10,000 people.

Future plans are thought to include the development of new businesses in mobile payments, supply chain finance, advertising, and opening brick-and-mortar stores. Whatever happens, it's likely Shein will do it ultra-fast.

Thankyou for reading! Please do subscribe.

Comments