The Spectacular Power of Luxottica

- Rohan Nidmarti

- Sep 9, 2021

- 4 min read

Buying new glasses can be an expensive undertaking. The fanciest of frames cost anywhere between $400-500. Holding those little glasses, you might wonder how exactly were you roped into paying so much. The answer is basic economics. Most frames are manufactured by a single company, named Luxottica. This Italian behemoth controls 70% of the global eyewear industry, and this monopolistic structure of the market leads to profits that are relatively obscene. Luxottica has a market cap of $88.45 billion & recorded revenues of $12 billion in 2020.

Brands Owned by Luxottica:

Persol, Luxottica, Ray-Ban, Oakley, Vogue, Oliver Peoples, Sunglass Hut, Target Optical, LensCrafters

Luxottica also makes eyewear for Giorgio Armani, Prada, Bulgari, Burberry, Chanel, Dolce & Gabbana, Versace, Ralph Lauren, Google, & Michael Kors

History:

Leonardo Del Vecchio started Luxottica in 1961 in Milan, Italy. Luxottica began as a contract manufacturing business, but by 1967 Del Vecchio started selling complete eyeglass frames. Convinced of the need for vertical integration, in 1974, he acquired Scarrone, a distribution company. In 1988, he set up the licensing business by partnering up with Armani. In short, Luxottica began controlling the entire supply chain. It acquired Sferoflex, which allowed the company to improve the design of its products.

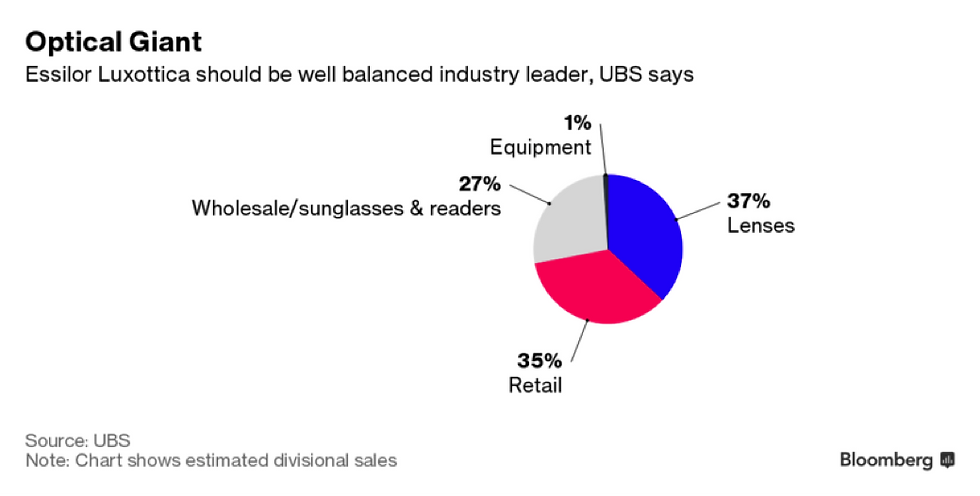

Luxottica made some high-profile acquisitions in the 90s, such as Vogue Eyewear, Persol, Ray-Ban, & Sunglass Hut. In 2007, it bought Oakley for $2.1 billion, & in 2016, Luxottica merged with Essilor, a French ophthalmic optics company, forming EssilorLuxottica the world's largest eyewear company.

Operating Model:

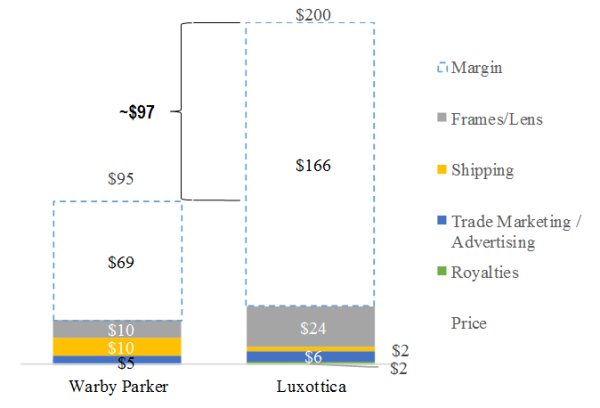

Because it controls so many prominent brands & retail chains, Luxottica is what economists call a price-marker. That means it can set the price of its goods near the highest amount that consumers would be willing to pay for them, unlike more competitive industries, in which competition both encourages constant innovation & forces the price of goods down toward what they cost to manufacture. Having control over the pricing of a huge variety of brands means Luxottica can carefully engineer the prices of different brands and position them distinctively in the market.

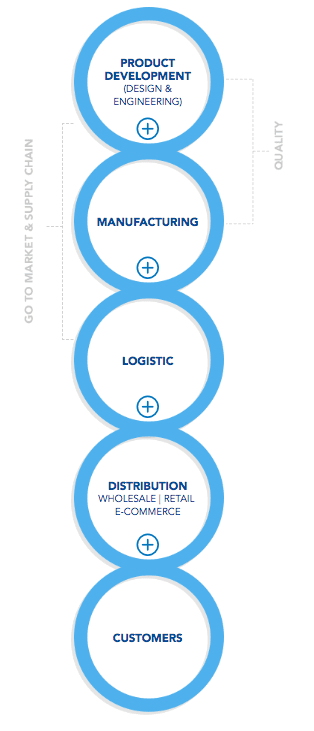

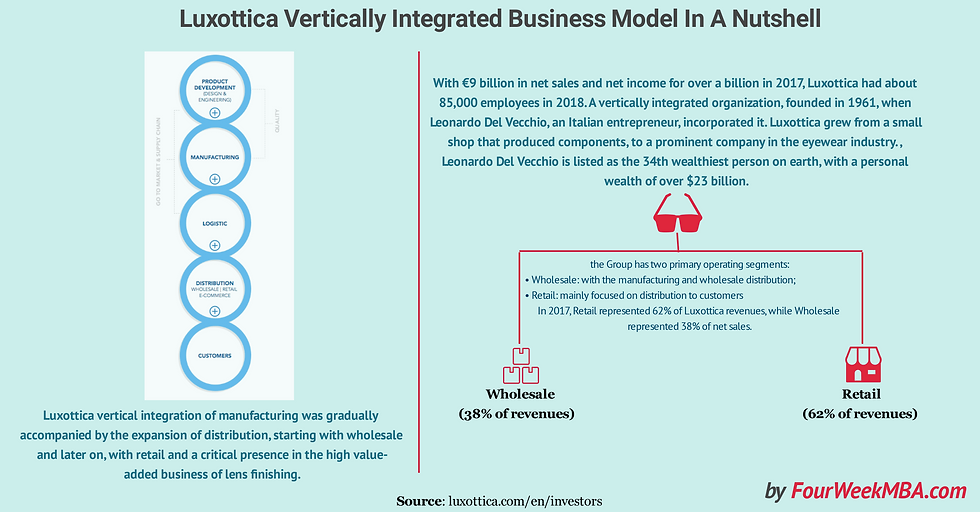

The vertical integration of Luxottica didn't happen overnight. Instead, it represented the fulfilling of a vision from its founder, as he started to produce entire frames, rather than just components. Vertical integration of manufacturing was accompanied by the expansion of distribution, starting with wholesale and later on, with retail and a critical presence in the high-value added business of lens finishing.

One of the critical aspects of vertical integration is the ability of the company executing it to control the quality of each step of the supply chain. These high standards is what Luxottica calls 'Made in Luxottica' standard.

One of the issues of a fragmented supply chain is the inability to understand customers, especially if the company is not controlling retail side of distribution. On the other hand, if a company is too focused on the retail side, it might be tough to lower the costs of materials, while keeping its quality pretty high. Vertical integration makes Luxottica aware of all its elements, giving a 360-degree view of its business.

Manufacturing & Distribution:

The group has two primary operating segments:

1) Wholesale: With the manufacturing & wholesale distribution

2) Retail: Mainly focused on distribution to customers

In 2017, retail represented 62% of Luxottica's revenues, while wholesale represented 38% of net sales. Luxottica has also built, over the years, an e-commerce platform to compete with Warby-Parker. The e-commerce division comprises of Ray-Ban, Oakley, Persol, Vogue Eyewear, & Sunglass Hut.

Product design, development, & manufacturing for frames take place in several facilities in Italy, Brazil, China, & the US. Luxottica has around 27,000 models in production at any one time, and its plants turn out 400,000 pairs of frames per day.

Del Vecchio's greatest is the one that changed the nature of the optical business - and that was to combine it with the fashion industry. Luxottica signed license deals with Armani, Prada, Miu Miu, and created a need for something which didn't exist before. Luxottica sells frames charging markups of 700-800%.

Global Trends:

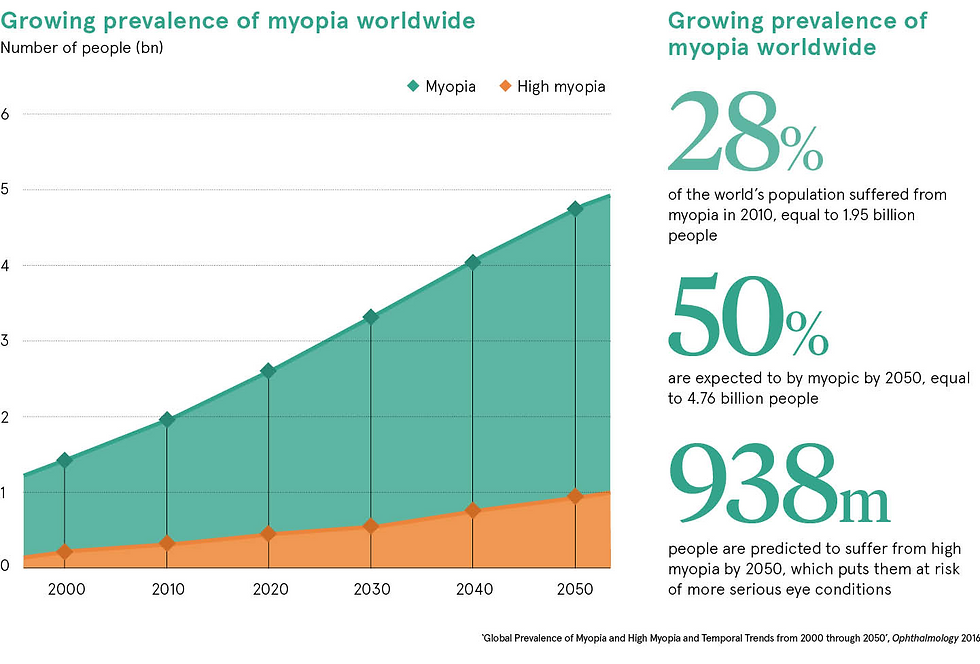

No one is exactly sure what it is about 21st Century human beings - the time we spend indoors, the screens, the colour spectrum in LED lighting, of the needs of ageing populations - but we are becoming a lens-wearing species. The need varies depending where you go, because different populations have different genetic predispositions to poor eyesight, but there is growing adoption of eyewear. In countries such as Nigeria, 90 million people, or half the population are now thought to need corrective eyewear.

There are two things going on. The first is a largely unreported global epidemic of myopia, or nearsightedness, which has doubled among young people within a single generation. For a long time, scientists thought myopia was primarily determined by genes, but about 10 years ago, it became clear that the way children were growing up was harming their eyesight too. The effect is starkest in East Asia: In China, 90% of teenagers & young adults are nearsighted. In South Korea, 95% of teenagers are myopic, many of them severely.

At the same time, across the developing world, a slower and more complex process is underway, as populations age and urbanise and move indoors to work. In 2018, an estimated 2.5 billion people, mostly in India, Africa, & China, are thought to need spectacles. This presents a staggering business opportunity to Luxottica, and expands their total-addressable-market.

Conclusion:

Luxottica holds more than 8000 patents & funds ophthalmology chairs around the world. It controls the entire supply chain for almost 70% of the industry from manufacturing to retail. It also owns vision care insurance companies.

In deals that rarely make the business pages, Luxottica buys up Belgian optical laboratories, Chinese resin manufacturers, Israeli instrument makers & British e-commerce websites. Within the industry, Luxottica is regarded as a kind of unstoppable, enveloping tide.

Thankyou for reading! Please do subscribe

Comments