What Went Wrong With Seagram's?

- Rohan Nidmarti

- Nov 8, 2021

- 7 min read

Updated: Nov 9, 2021

"Shirtsleeves to shirtsleeves in three generations" for the Canadian liquor-and-media Bronfman family actually means they're left with about one billion dollars between them. They won't starve, but they're a fraction of what they were 40 years ago. The Bronfman's built up a completely new kind of giant global business in liquor in 65 years - spirits and wines were resourced from everywhere - and then bet the business and lost it in a couple of years in the international media and dot-com boom. To understand the unmaking of the Bronfman dynasty, one needs to take a look at the past.

History:

Samuel Bronfman's Distillers Corporation acquired Joseph E. Seagram & Sons of Waterloo, Ontario, Canada from the heirs of Joseph Seagram in 1928. Bronfman eventually built an empire based on the appeal of brand names developed previously by Seagram's - including Calvert, Dewars, & Seven Crown. His sales were boosted during the United States' abortive experiment with prohibition, and he was able to do so while staying within the confines of both Canadian law, where prohibition laws had been repealed, and American law. The Bronfman's created their wealth by making Canadian whiskey that eventually found its way to eager American buyers during Prohibition.

By the late-1960s, Seagram's was witnessing a slowdown in its core whiskey business as clear liquor - vodka, gin, tequila - started gaining prominence. Around the same time, Samuel Bronfman handed over the reigns to his youngest son, Edgar Bronfman Sr, who engineered a successful transition of Seagram's by acquiring a small Swedish vodka brand named Absolut - 4th largest vodka brand in the world today. By 1979, Seagram's had a range of clear liquor brands such as Captain Morgan, Absolut, Seagram's Extra Dry gin, Seagram's vodka. It was also the largest distiller in the world. In 1987, Edgar Bronfman engineered a $1.2 billion takeover of French cognac maker Martell & Cie.

Because of changes to US tax law in the Lyndon Johnson administration, it became advantageous for Samuel Bronfman to own an oil company, which he did with the purchase of Texas Pacific Coal & Oil Co. in 1963 for $50 million. In 1980, Edgar Bronfman sold the Texas Pacific Oil holdings to Sunoco for $2.3 billion. In 1981, cash-rich and wanting to diversify, Seagram's engineered a takeover of Conoco, a major American brand of oil and gas. Although Seagram's acquired a 32.2% stake in Conoco, DuPont (world's largest chemical company) was brought in as a white knight by the oil company and entered a bidding war. In the end, Seagram's lost out to DuPont, but in exchange for its stake in Conoco, Seagram's became a 24.3% owner of DuPont.

By the early-1990s, Seagram's was the world's second largest alcohol company, and the DuPont stake accounted for 65% of annual revenues. The company had a spate of popular brands such as Chivas Regal, Martell, Captain Morgan, Glenlivet, Absolut, Dewars, Glen Grant, Royal Salute, Seagram's Extra Dry gin, Crown Royal, and V.O Canadian whiskey. In 1994, Edgar Bronfman Jr. took over Seagram's and launched its foray into Hollywood - initiating the biggest wealth destruction.

Media Ambitions:

In 1995, Edgar Bronfman Jr. was eager to get into the film and electronic media business. Bronfman proceeded to a brief career in entertainment in the 1970s as a film and Broadway producer. As soon as he took control of Seagram's, Edgar Jr. led the family on a series of disastrous business deals, ultimately losing control of Seagram's.

The first step in this diversification was the widely criticised sale of Seagram's stake in DuPont. This stake in DuPont, by 1995, represented 70% of Seagram's earnings. DuPont announced a deal whereby the company would buy back its shares from Seagram's for $9 billion.

Bronfman used the proceeds of the sale to acquire a controlling interest in MCA from Matsushita (now called Panasonic) for $5.7 billion. MCA was a major force in the film industry. MCA published music, booked acts, ran a record company, represented film, television, and radio stars, and produced and sold television programs. Its assets included Universal Pictures and its theme parks, USA Network, & Universal Music Group. Edgar Jr. also acquired a 14.9% stake in Time Warner (the word's largest media company then) in 1993.

In 1998, Seagram's sold a part of its Tropicana juice business for $4 billion, a move criticised by many. Edgar Bronfman Jr, then led the takeover of Netherlands-based PolyGram from Philips for $10 billion. PolyGram was a major music record label and helped Seagram's become the world's largest music company. PolyGram was folded into Universal Music Group and PolyGram Filmed Entertainment was folded into Universal Pictures. PolyGram's assets included ITC Entertainment, A&M Records, Island Records, & Motown Records. By 1999, Seagram's owned the rights for a majority of musicians across the world including the Beatles, Elton John, U2, & ABBA.

Merger:

By late-1999, Edgar Jr. realised that Seagram's would never be big enough to swim with the entertainment industry's biggest fish - Time Warner, News Corp, Disney, or Viacom. In 2000, at the peak of the dot-com boom, Edgar Bronfman Jr. sold the entertainment division of Seagram's to French telecom company Vivendi for $35 billion; the combined company would be known as Vivendi Universal. Seagram's once sound balance sheet had been badly eroded by Edgar Jr.'s aggressive deal-making. Long-suffering shareholders and even Junior's staunchest outside critics acknowledged that, on paper, the Vivendi bid was simply too good to turn down.

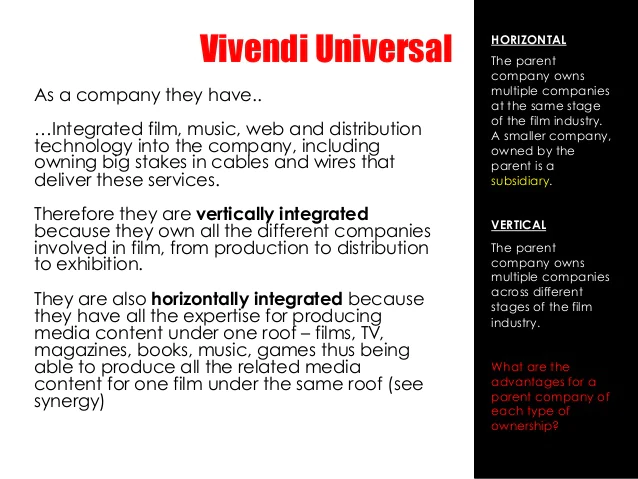

Vivendi began as a water company in 1853. By 1980, it began diversifying its operations from water into waste management, construction, energy, and transport services. In 1983, Vivendi helped to found Canal+, the first pay-TV channel in France, and in the 1990s, they began expanding into telecommunications and mass media, especially after Jean-Marie Messier became CEO in 1996. Messier launched a series of expensive acquisitions and divested Vivendi's revenue producing assets.

In 1996, Vivendi acquired Europe's largest film studio, Berlin-based Babelsberg Studio. Vivendi created Neuf Cegetel to take advantage of the 1998 deregulation of the French telecommunications market, accelerating the move into the media sector. In 1997, Vivendi sold of its core property and construction divisions to what would become Vinci SA - $63.1 billion company today. Vivendi went on to acquire stakes in or merge with Maroc Telecom, Havas, Cendant Software, Grupo Anaya, and NetHold. Beginning in 1998, Vivendi launched digital channels in Italy, Spain, Poland, Scandinavia, Belgium, and the Netherlands.

In 1999, Vivendi acquired Pathe for $2.6 billion, and retained its interests in British Sky Broadcasting Group and CanalSatellite. Through this acquisition, Messier was able to enter the competitive and lucrative British media space. Messier realised that there was one key missing piece as he constructed his New Economy media giant: a major Hollywood studio that could provide content to stuff into all the new telecom, cable, and Internet pipelines he was building. This vertical integration made immense sense on paper, and Edgar Jr. wanted to compete with the newly formed AOL-Time Warner.

2001 Onwards:

On 8th January 2001, Vivendi acquired Seagram's for a 45% premium, creating the second largest media company. The Bronfmans could have taken cash, however, Edgar Jr. sold the vision of a New Economy media and telecom behemoth to the family, and they traded their 24.6% of Seagram's for 8.6% of Vivendi Universal, making them the biggest shareholder. The Bronfmans were worth more than $5 billion.

By the time the transaction closed in December 2000, the dot-com bubble had burst. Media and internet stocks were tanking, and telecom, particularly the wireless kind in which Vivendi had enormous investment, would soon join them in the gutter. Vivendi's share price fell by 40%, and this was the first sign that Edgar Jr.'s 'Deal of the Century' would put a severe dent in the family's fortune. Despite mounting losses, Messier made a few more expensive and disastrous acquisitions such as MP3 for $375 million, and leading American publisher, Houghton Mifflin for $2.2 billion.

Downfall:

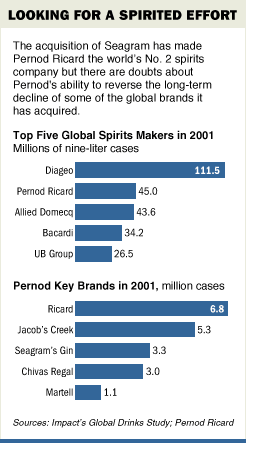

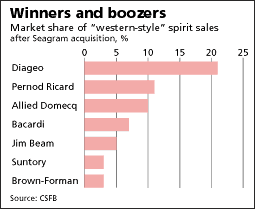

In October 2001, Vivendi's environment division - now known as Veolia (valued at $26.8 billion) - was divested through IPOs. Vivendi Universal disclosed a corporate loss of $28 billion in 2002. The company began reorganising to stave off bankruptcy, announcing a strategy to sell non-strategic assets. The Bronfman family put the booze and wine operations on the auction block. The business which generated about $6 billion in sales annually, was later sold to two longtime rivals, Diageo and Pernod Ricard, for $8.1 billion, below the market rate. In 2002, The Coca-Cola Company acquired the line of Seagram's mixers (ginger ale, tonic water, club soda). In a 2013 interview, Charles Bronfman stated about the decisions leading to the demise of Seagram's: "It was a disaster, it is a disaster, it will be a disaster. It was a family tragedy".

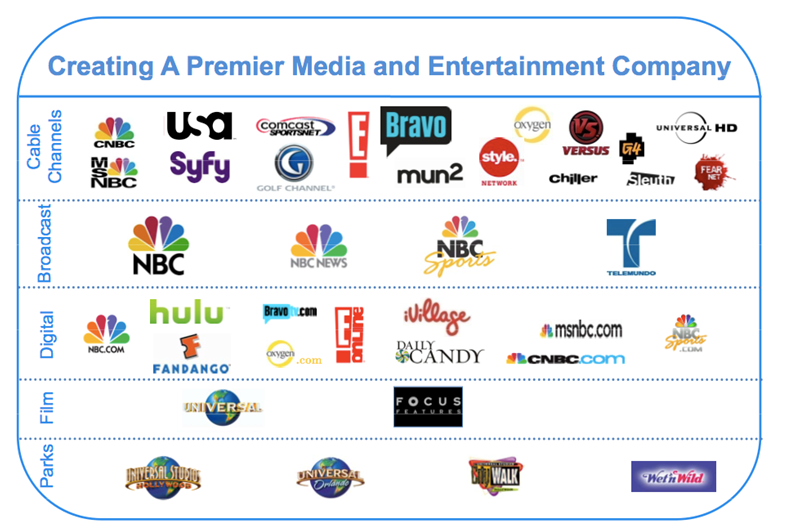

By 2003, Vivendi Universal's share price had dropped by almost 84% - since its 2000 peak. The Bronfman family lost almost $3 billion, one of the largest wealth destructions ever. In 2004, 80% of Vivendi Universal was sold to General Electric for $16 billion, to form NBCUniversal, and by 2007, Vivendi had sold of most of Messier's acquisitions. The company's minority stakes in Veolia and Vinci were also sold off.

Conclusion:

I, for one, believe that Edgar Jr. had an incredible vision for the music industry back in the 90s. Universal Music Group, Junior's baby, is now worth almost $50 billion, and is the largest player in the global music industry. Junior adopted digital distribution for music back in 2004, two years before Spotify and Amazon Music. In the press, he was portrayed as a lightweight dilettante drawn to Hollywood's glitz and glamour. He was perhaps too intent on doing big, risky deals to live up to the legacy of his father and grandfather. His biggest mistake was selling to Vivendi, a fraudulent house of cards, inflated by a boom market and madman, Jean-Marie Messier. Seagram's entertainment division was a fundamentally strong business with growing revenues and profits - worth almost $140 billion today - however, Vivendi destroyed it.

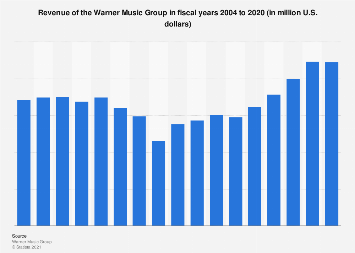

In 2004, Edgar Bronfman Jr. staged a comeback by acquiring Warner Music Group - the world's fourth largest music company - for $2.6 billion. It seemed like an awfully rich price. Almost everybody was running away from the music industry, which was still reeling from digital piracy. By 2010, he had grown WMG by 50%, and sold the company to Access Industries for almost $3.9 billion. In 2017, Meredith Corp and a group of investors led by Junior acquired Time Inc. for $2.8 billion. It will be fun to see how Edgar turns around the storied publisher.

Seagram's is a fantastic story of wealth creation and destruction. The Four Seasons restaurant at the posh Seagram Building on Park Avenue is all that remains today, including works by Picasso, Rothko and other modern masters. Edgar Jr. may emerge from the ashes and manage to resuscitate Time Inc. and extract real value from what's left. For now, the best he can hope is that no one remembers how he traded his family's crown jewels for the fantasy of a global media empire.

Thankyou so much for reading!

Comments