The Burgeoning Indian Startup Ecosystem

- Rohan Nidmarti

- Apr 17, 2021

- 3 min read

Updated: May 27, 2021

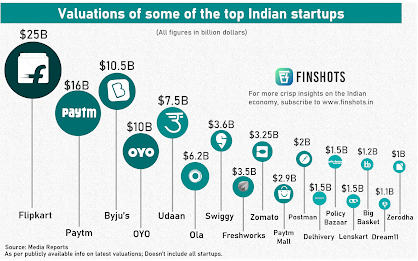

Only four months into 2021, India has added ten new unicorns (to put it into context, India added eleven unicorns in 2020). The startups that entered the unicorn club in 2021 are: Digit Insurance, Innovaccer, Meesho, Infra.Market, PharmEasy, CRED, Groww, ShareChat & Gupshup. At this pace, India is likely to see 100 unicorns by 2023. India now has the third largest number of unicorns, ahead of countries like UK and Germany.

Global marquee investors like Sequoia, SoftBank, Alibaba, Naspers & Tiger Global are pumping billions of dollars into Indian startups. SoftBank CEO, Masayoshi Son, recently said SoftBank is like a 'goose' giving 'golden eggs' referring to SoftBank's portfolio companies, Coupang & DoorDash going public with mega-IPO's. In India, its portfolio firms like PolicyBazaar and Delhivery are actively working towards going public. On the other hand, Tiger Global's confidence in young firms isn't new found. It invested in Flipkart & Ola, at a time when both firms were struggling to raise money.

India's edtech market is booming and the it is now home to two of the world's largest edtech platforms (Byju's & Unacademy). Edtech is headed for 8x-10x growth in the next 5 years due to the massive adoption of online education post the outbreak of the pandemic. Byju's (valued at $15 billion) recently acquired Aakash Educational Services for $1 billion in order to solidify their presence in India's brick-and-mortar test prep industry. Amazon also entered the edtech market by launching Amazon Academy in India. Furthermore, the government recently announced the National Education Policy, which when implemented, will see a massive public spending. Another factor that will fuel the edtech sector is India's unusual demography. India has more than 50% of its population below the age of 25 and the average age of an Indian is 29.

Fintech is another aggressively growing sector in India. India's evolution as a progressive fintech nation is partly due to government led initiatives like Aadhar & Digital India. Paytm (valued at $16 billion), a payment system company, is India's largest startup with investors like Ant Financial and Berkshire. UPI is gaining traction in India and it'll be fun to see how the industry plays out especially with the arrival of global players like Facebook, Google, Samsung & Amazon. Flipkart recently spun off its UPI subsidiary PhonePe. Millennials in India are driving a surge in stock trading and they are mostly doing it with the help of fintech online brokers such as Zerodha, Groww & Upstox

E-commerce is a thriving sector in India. Reliance Retail (and its online venture, JioMart) received $6.5 billion of funding from illustrious PE and sovereign wealth funds such as TPG, General Atlantic, GIC, Mubadala etc. Reliance also acquired significant stakes in UrbanLaddder, Zivame, and Netmeds. JioMart is an online delivery service that will deliver anything from medicines to furniture to toys (Reliance also owns Hamleys). The Tata's have also entered the e-commerce space with acquisitions such as BigBasket & 1mg (rumour has it that Walmart is investing $25 billion into Tata's superapp). Amazon is another large player in the Indian e-commerce space. Flipkart, an Indian e-commerce giant now owned by Walmart is planning to go public with a $35 billion valuation.

Transportation (ride-hailing and food delivery) apps have witnessed exponential growth in the past year. India has a duopoly in the ride-hailing space with Ola and Uber. Ola has also expanded internationally into geographies like Australia & UK. Ola spun off its electric vehicles business into a separate unit called Ola Electric Mobility which has received funding from Ratan Tata and SoftBank. The company is now building the world's largest two wheeler factory with annual capacity of 10 million units. Due to restaurants being shut during the pandemic, food delivery apps such as Zomato & Swiggy experienced phenomenal growth (Swiggy is now valued at $6 billion). Uber Eats, unable to face its local competition, sold its Indian division to Zomato for $400 million in 2020.

India, with its 1.3 billion population is witnessing a digital revolution. Internet and broadband penetration has grown at a rapid pace both in urban and rural areas. The subcontinent has also seen the the explosive growth of cheap internet services (commonly called the Jio phenomenon). 800 million people in India have internet access. There are also physical infrastructure changes such as electrification. India is also experiencing a new crop of ambitious entrepreneurs. Global investors are bullish on India and its startup ecosystem which is only poised to grow from here on.

Very informative:)