The $175 Billion Company You've Never Heard Of

- Rohan Nidmarti

- Jun 4, 2021

- 3 min read

Imagine a company that is worth more than the combined market cap of BMW, Ford, and Kia. Well, such a company exists and it's called Prosus, an Amsterdam-headquartered consumer tech company not many people are aware of. Prosus is many things: a media company (like Bertelsmann), a tech investment firm (like SoftBank), and a holding company (like Berkshire Hathaway). To understand Prosus, we need to take a look at its history.

Naspers is a 106 year old South African company. It began it's operations as a publisher of magazines & newspapers. It also added book publishing to it's portfolio. Naspers' publishing assets became the mouthpiece of the Apartheid movement. In the 80's, pay-TV operator MTN merged with Naspers and Koos Bekker (an individual integral to Naspers' success) became the CEO. In the late-90's, Naspers under Koos started making a number of investments in Chinese tech companies. While most of them were unsuccessful, one investment became the greatest venture capital move of all time.

In 2001, as Koos was leaving Beijing, he was approached by two young men who had started an internet operation called Tencent, which was already signing new users at a remarkable pace. Koos invested $32 million and took a gamble on 46.5% of their company. Today, Naspers owns 29% of Tencent worth a whopping $232 billion! In 2007, Naspers bought 30% of the Mail Russia Group, Russia's largest tech company, for $165 million. Today, Naspers' investment is worth $10 billion. Very soon, Naspers transitioned from a South African media company to a global investment firm.

In 2012, 80% of Naspers stock price was based on their Tencent stake, and 10% on their Mail stake. This meant that all the other activity of the company was valued at only 10% of the total stock. Investors perceived higher volatility, since Naspers was dependent on Tencent. On top of this confusion, Naspers primarily traded on the Johannesburg Stock Exchange, and the African currency Rand is highly volatile. Also, Naspers size compared to the JSE was becoming an issue. Hence, the Tencent investment became a double-edged sword for Naspers.

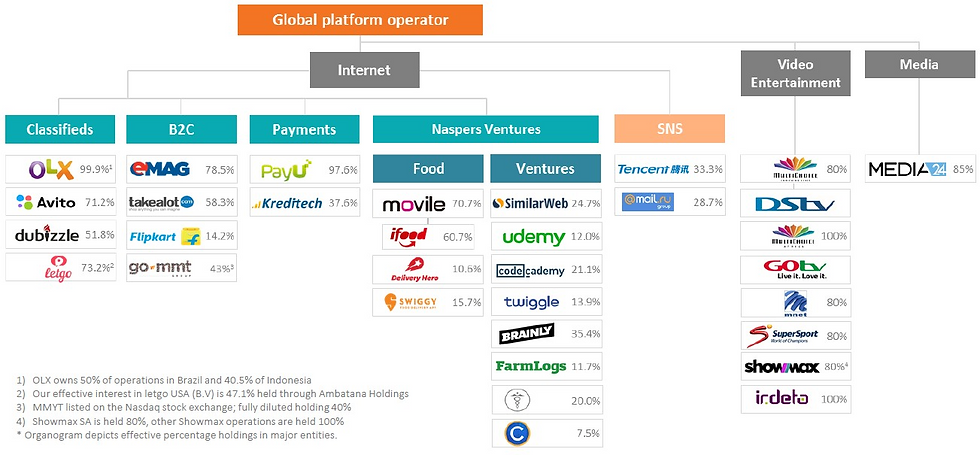

Naspers, under Bob van Dijk's leadership, started diversifying. In 2019, it listed it's investment assets on Euronext Amsterdam, as Prosus. Today, Prosus invests in a few key areas.

Online Classifieds:

In 2014, Prosus acquired 95% of OLX, and later acquired Avito, a Russian classifieds company. This made Prosus the largest online classifieds company with annual revenues of over $2.5 billion. It also owns Letgo, Spain's largest classifieds business. Their classifieds business is well consolidated and established. It is a highly competitive space where winner takes all. I think Prosus will acquire Adevinta (valued at $13 billion).

Classified marketplaces don't go across geographic borders. There is only room for one major player per country, the perfect field for M&A. Prosus can become the unthreatened world leader in online classifieds.

Food Delivery:

The food delivery business is also a marketplace but a more underdeveloped one. Prosus owns stakes in Swiggy (India), Wolt (Scandinavia), iFood (Brazil), and Delivery Hero (Europe). It'll have to invest heavily in this space before it shows any profit.

E-Commerce:

Prosus' e-commerce business is mostly a South African play. It owns Takealot, South Africa's largest e-commerce business. It also owned majority stakes in Souq (divested to Amazon), and Flipkart (divested to Walmart). It made a windfall on both these investments.

Fintech:

In the past few years, Prosus has been bullish on fintech companies. It acquired major stakes in Creditas, Brazil's largest digital payments company and Klar, a Mexican neobank. It also owns PayU. The payments business is supplemental to the marketplaces and gives Prosus access to large consumer groups.

Road Ahead:

Apart from these certain themes, Prosus has backed major companies: Byju's, Brainly, PharmEasy, Urban Company, MakeMyTrip, and Udemy. However, Prosus still hasn't convinced investors that they have fundamental value apart from their Tencent stake. The volatility of the stock remains, and the dependency on Tencent too.

All in all, the essential question is: can Prosus do it again? Can it replicate it's Tencent success with another of its portfolio company? If it can, the market will look at them differently. The net asset value of Prosus is $275 billion, but it's market cap is $175 billion. The very success that put them on the map is holding them back. No one knows the double-edged sword like they do.

Naspers/Prosus is still the most underrated tech investor, that almost no one has heard of.

Thankyou so much for reading! Please subscribe!

Had never heard of it. Very informative.